I can still vividly recall that not too long ago, the Dow fetched many of us the bacon with an all time high. Not too surprisingly but more of shockingly, we made history once again. Between last Christmas and the next which has yet to arrive, the Dow has fallen by 5600 points.

I use to think market watching gets a little interesting at times simply because you get to witness the funny things we do to drive the market crazy. And I get especially thrilled taking a random walk down Wall Street to see the market go on steroids. Somehow, this time if you see what I see, you might share my sentiment – this is not funny anymore.

Start with this for some quick reality check to digest – many major football clubs that you and I love ever so much are in severe debt due to the credit crunch and I shit you not, they may be going down if they don’t get it sorted out.

A friend (Ye Zhong) said to me today, “Wah Eugene, the Dow is quite shag. Think about it, it has fallen 600+ plus points (-10%) in one day."

A true friend I am as usual, I’ve been thinking about what that 10% plunge is signaling. Then I start to see the signs as to how bloody low the word “shag” can bring us down to. I hope Ye Zhong feels the same way too, as I continue now to read into that number to come up with an answer.

Try this with me. What do you see?

This test has probably been done a million times. Yet it continues to provide one of the key reasoning to account for the mess that we’re in right now. Perception, perception. Everyone’s seeing the market as a half-empty glass of water, totally ignoring the fact that it is actually half-filled. Why buy now when it only gets cheaper? Unless we start believing that we cannot go lower further together, we’re going down in this bear market together.

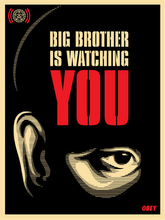

Let’s leave humans being humans aside and go right into governments being governments. The regulators did their jobs. I bet you noticed that when they started deciding who should fall and who shouldn’t. We all feel their presence, and of course we recognize their power even more when they go deep into their pockets to make sure the best companies stay in this bear market. I welcome rebuttals for this stand but I feel very strongly that it is time. It is time they reciprocate this very public recognition and respect of their power by also recognizing the power of the free market. Let the bad barrels fall and the market will correct itself. Yes, no doubt they were good barrels once, and they drove the economy during the glory days, but it is time we start afresh. While one may argue that good barrels in the markets now are what make the apples good, I beg to differ. In actual fact, it has never been this way. Markets fall, barrels topple, but good apples will always stay.

As the big forest fire continues to burn - pardon me - let the motherfucker burn. Quit trying to stop it with human intervention. Leave it be and as history has proven it, between now and zero, there will come a point where we start flat, ready to grow our trees again.

I guess it doesn’t take too long before another 2 investment houses get nationalized, but I still see no volunteers to take the lead to drive the bull down Wall Street again. Well who can we blame? It is human nature, after all.